After 50, you must take a hard look at your situation. If you have not yet obtained financial freedom, now’s the time to see to it.

What exactly is financial freedom? In short, it’s the ability to live the life you want while still paying your bills without stress.

Why is financial freedom after 50 important? When you’re in your 50’s, retirement is right around the corner. The next 10 to 15 years in your career will be pivotal to achieving your financially free retirement years.

When you’re in your 20’s, it’s easier to plan out how to pay off debt and save because your accumulation of debt isn’t too high and you have the time to plan a pay-off method. Nonetheless, here are a few ways to achieve financial freedom after 50 and have stress-free retirement years.

Assess Your Financial Situation

Before you begin to leap toward financial freedom, take a step back to assess what your current money situation is and map out a strategy.

Take some time to evaluate your finances and look into everything from your net worth, debts, retirement, investments, savings, and even your credit score.

Start by compiling all of your debts into one place. These debts might be your mortgage, car loans, credit card debts, student loans (you could still have them!), other personal loans, and anything else you might be paying on. Then add everything together to see what you owe in total.

Now, look at your assets and all the money you do have. Add up what money you have in any savings accounts, retirement accounts, stocks, bonds, mutual funds, or even cash you might be storing right at home. From here, you can better assess what goals you want to accomplish for achieving financial freedom after 50.

Establish Goals for Financial Freedom After 50

Your next step is to put yourself in control of your money and establish financial goals. Ask yourself, “Why do I need money, and why do I want to achieve financial freedom?”

It might be because you want to pay off credit card debt, pay off your mortgage, plan to retire early, or build your general savings account (i.e. for when your child gets married or to plan a vacation).

Take a piece of paper and pen and physically write down the financial goals you want to achieve. For instance, say you want to plan on paying off all your credit card debt and get your retirement account to $100,000 before you turn 60. It helps me to have a goal planner or journal.

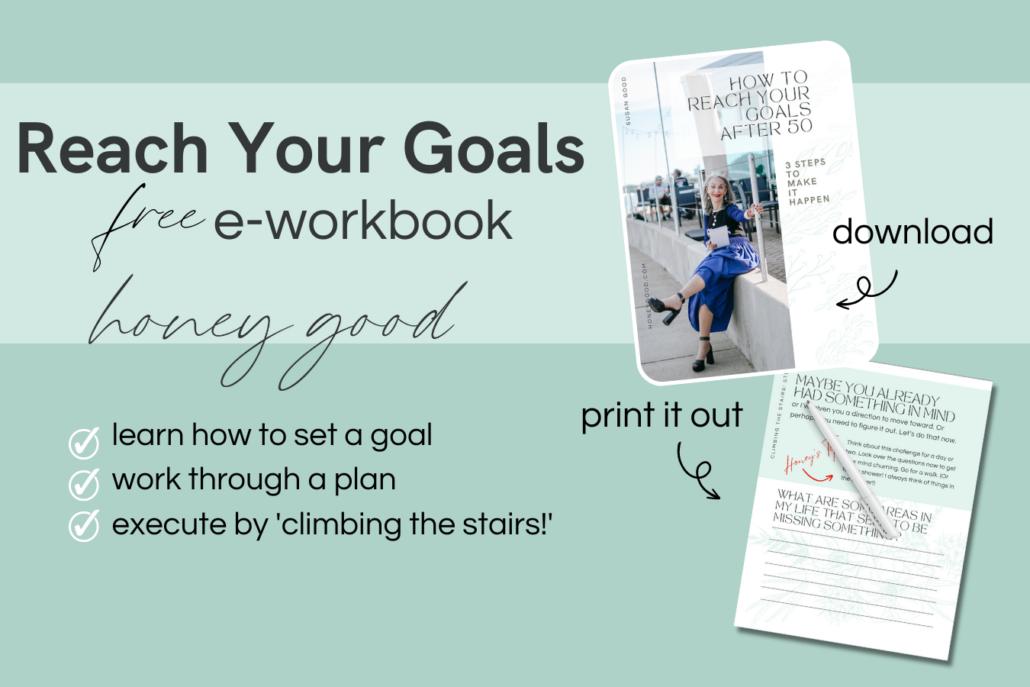

Even though the goal you set for yourself might not happen in a month, it’ll make it way easier to achieve financial freedom after 50 when you know your debt to income ratio and have actionable goals set to work towards. All goals are achievable when you break them into small steps and create a plan to take action. I have created an amazing workbook to help guide you as you set goals. Download it for FREE here.

Pay Off Outstanding Debts

Now that you have a better understanding of where you are financially in your 50’s and where you hope to go, you can only do so much until you pay off outstanding debts.

The average American has $90,460 in debt with baby boomers (ages 56-74) at $97,984 and gen x (ages 40-55) at $135,841. Whether that’s from credit cards, personal loans, mortgages, or student loans, it’s not uncommon to have high levels of debt, even in this stage of your life.

Nonetheless, you still have time to achieve your financial freedom goals before retirement, and one of the easiest ways to settle debt is to consolidate what you owe into a single payment. While you could take from your retirement account or savings to pay it all off, you would be hurting your other goal of building your savings.

The other option for settling your debt and not disturbing the savings you already have is through the use of an unsecured personal loan. You can add together, for example, your mortgage payment, credit card debts, and other personal loans you have, then apply for a personal loan in that amount. Once the funds get released to you, pay off all your debts, and then focus on that one debt payment to make it easier on you and your budget plan.

Boost Retirement Contributions for Financial Freedom after 50

While it may seem daunting to be inching closer and closer to life after work and worrying about bills, it is possible to pay off debt and save for retirement at the same time. In your 50’s, it’s essential to focus heavily on building savings in a 401(k) employment retirement account or Individual Retirement Account, or IRA.

In the world of finance, it’s a common recommendation to “pay yourself first.” If you aren’t familiar with this saying, it’s the practice of putting money away into retirement before paying for anything else. If you don’t already have automatic payments go into a retirement account at work, look into this, or set something separate up with your bank.

At this stage in your life, you’re likely at your peak earnings, making it easier to put extra money away without noticing a difference in your lifestyle. For example, if you have hit a certain percentage of raises, take a step back and increase the amount you are putting away for retirement. Even if you have been living with a higher amount of discretionary income, at this time in your life, it’s best to increase what you “pay yourself first.”

What you do with any extra income is crucial in your 50’s. If you aren’t an expert, it might even be a good idea to get a financial planner to help you establish the best options for growing your money with stock, bonds, and other investments.

Now is the time to take control of your finances and dive into achieving your financial goals. Retirement and financial freedom are right around the corner. All you need to do is assess your financial situation, choose your goals and go for them!

We recently paid off all of our debt; we owe no one anything, anywhere. I would agree that paying off debt is the best first step to financial freedom, but would suggest that a personal loan, although it consolidates and makes payment easier, does not address the crux of the matter; behavior. Behavior needs to change; we all need to stop spending money we don’t have on things we don’t need. We used the debt snowball approach; list all debts smallest to largest, regardless of interest rates. Pay all the minimum payments, and budget so that extra money goes on the smallest debt. When that is paid, put that minimum on the next smallest debt, and so in. It took us about 1 1/2 years to pay off all our consumer debt using this method.

I am hopeful many read your comment. Very wise. Thank you for taking your time to address this very important issue. Warmly, Honey