One of the biggest challenges for people over 65 and certain people under 65 with disabilities is navigating Medicare. When my husband and I chose our plan we wanted to ensure we considered our budget and our lifestyle. It was also important to us to make sure our primary doctor and specialists were covered, in addition to our prescription drugs, and other benefits we needed, like dental coverage. We are also avid travelers so we wanted to make sure we had healthcare coverage during our travels at home and abroad.

We chose to seek the advice from a person specializing in Medicare coverage because in our minds this was not a luxury; it was a necessity. And, we were correct because her skills have and are serving us well.

Do Your Due Diligence

It’s important to do your due diligence. Ask questions. Become informed. I know from personal experience how important this is.

On a trip to Arizona to visit our children, a driver plowed into the passenger side of our car throwing me out onto a very busy thoroughfare. I believe I survived because I was asleep. I was in an intensive care hospital in Scottsdale, Arizona for over a week, and Medicare and our Medigap supplemental plan together paid all of my expenses. Choosing the right Medicare plan made my husband’s and my nightmare less daunting.

But signing up for Medicare is confusing!

Each plan has different premiums and many plans offer different benefit options, prescription costs, and networks of healthcare providers. It is hard to compare the benefits of each plan and understand the trade-offs. That’s why many people use a Medicare advisor, agent, or broker to help choose coverage. Did you know insurance companies are prohibited from charging a different premium if you use an agent instead of purchasing directly from the carrier?

That’s why I want to talk to you about a free service available to you that can help you get the coverage you need without all the hassle and confusion.

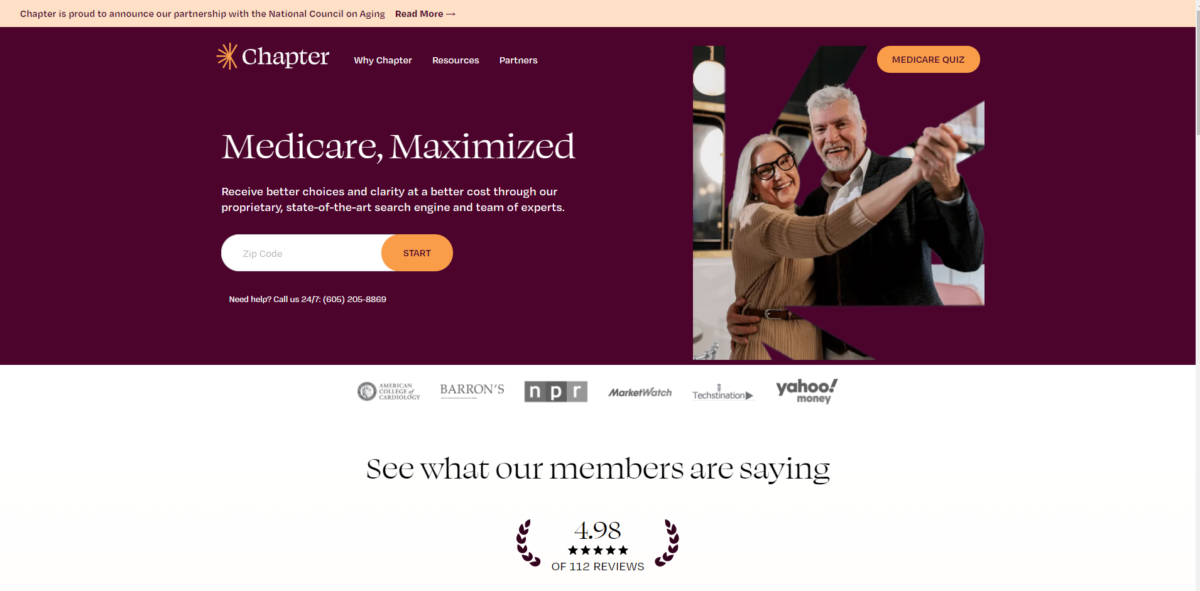

All About Chapter

Chapter was co-founded by Cobi Gantz who watched his own grandfather, Henry, who was a Holocaust survivor struggle to sign up for Medicare. Gantz also watched the difficulties his parents faced when they became eligible for Medicare when they turned 65. You can read more about Cobi’s story here.

Cobi’s story is sadly the norm. Medicare is confusing and complicated and many people who are turning 65 often feel very overwhelmed. Every day 10,000 people retire and they need guidance as they navigate Medicare.

Chapter is a tech-enabled Medicare Advisory organization. The company was founded to help guide people who first enroll in Medicare as well as provide best-in-class service for those who want to switch their healthcare plans to optimize their coverage at an affordable cost. Chapter’s licensed advisors help guide people through their journey and help them choose the best plans, for free!

Chapter’s service is used by thousands of Americans nationwide who are navigating Medicare. Chapter is also a trusted partner of the National Council on Aging (NCOA) which is America’s longest-running advocacy organization for older adults. The NCOA has designated Chapter as meeting its rigorous Standards of Excellence for Medicare Guidance. This came as no surprise to me because the company has an average rating of 4.98 stars (out of 5!).

When choosing a Medicare advisor, it is extremely important to ensure the person you choose is acting in your best interests. The Chapter team has put together a blog here to equip people with the questions to ask any advisor they choose to work with to ensure the advisor is putting their interests first.

But how do you choose a Medicare advisor?

Choosing a Medicare plan can feel overwhelming and confusing, that’s what Chapter is here for – they want to help. They’ve even put together the top 5 questions you should ask ANY Medicare Advisor that you choose to work with.

1. Does the advisor search every single Medicare plan in your area?

Any advisor you consider working with should be searching every single carrier to ensure you are getting the best coverage that is right for your individual needs and not just the plans that pay them the most when you sign up.

2. Does your advisor consider the credit rating of the carrier?

Like any other business, insurance carriers sometimes go out of business. It’s rare, but when it happens it can be very disruptive. Making sure you are getting an insurance carrier with a strong credit rating is important. A strong AM Best rating indicates that a particular carrier is unlikely to be at risk of going out of business.

3. Does your advisor forecast future premium changes in plans to help clients understand future cost exposure?

Don’t get surprised by rate increases! If you initially consider signing up for a Medicare Supplement plan — also known as a Medigap plan — an agent will typically offer you a quote with initial monthly premiums. Make sure any advisory you are considering assesses potential future premium increases across carriers, in addition to current premium rates.

4. Does your advisor take into account the doctors you see, the prescriptions you take, and your care priorities?

It is important you also ask whether the advisor considers all doctors that are important to you and makes sure you get a plan where the services from those doctors are covered. This includes doctors you see several times a year as well as the ones you see once a year. And don’t forget to check that the plan covers the prescriptions you take as well! This is a very important factor to take into account when working with any advisor.

5. Ask an advisor, “Over the last month, have you recommended that at least 5 people choose a plan that doesn’t pay you commissions?”

The best advisors should put you at the center of every recommendation they make. Unfortunately, this does not always happen. Most advisors can point to a few examples when they’ve done this, but it’s few and far between. The best advisors make this standard practice.

How Is Chapter Different?

Chapter is a tech-enabled platform that searches every Medicare option nationwide which amounts to more than 24,000 options. This level of breadth and granularity of search is not available anywhere else. The company helps older Americans switching Medicare coverage or moving to Medicare from individual coverage to save more than $750 per year, on average.

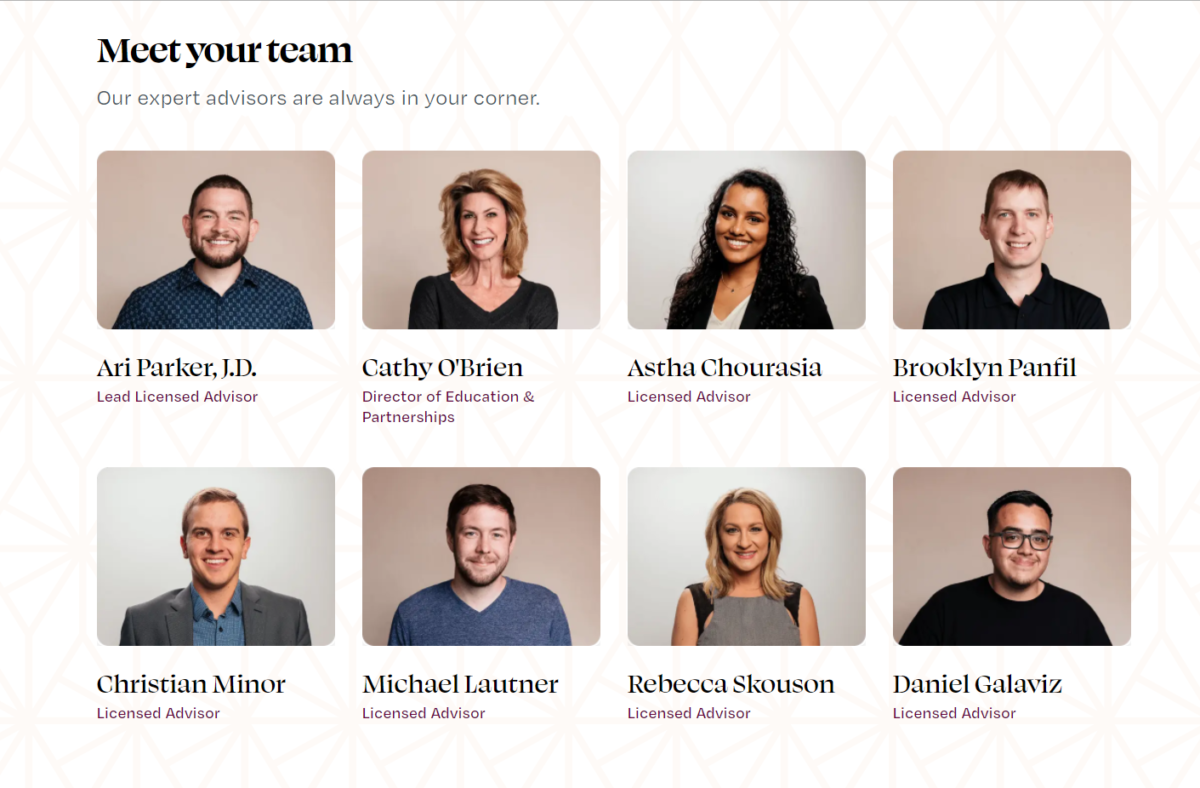

Chapter’s team of licensed Medicare advisors helps guide thousands of Americans through their Medicare journey. They will help you enroll for free as well as help you switch your plans in order to optimize your coverage.

If you would like to speak with a licensed Advisor to enroll in a plan or to find out about how to improve your healthcare coverage at a more affordable cost, you can call 304-982-8504 to speak to a dedicated licensed advisor.

A special offer for Honey Good readers, that’s YOU!

Chapter’s team of licensed advisors also hosts virtual educational seminars on Medicare across the country. These free seminars walk through the basics of Medicare, common mistakes people make, and ways to maximize savings. Chapter partners with nonprofits, religious institutions, healthcare organizations, and community leaders. The team is pleased to offer these free educational seminars to Honey Good readers. If you have a community that may be interested in hosting an educational virtual seminar with Chapter, you can email the team at seminars@getchapter.com. You can also call 602-609-8958 to speak with a licensed advisor who will help you and your loved ones navigate Medicare.

If you enjoyed this article, please subscribe to my email list. When I post a daily story, you will receive it in your inbox.

Thank you so much, Honey for that information. It’s timely & I will definitely avail myself of it.

Hi Maria, We are going to have a free tutorial with an expert from the company. Watch for the sign up on Honey Good, in your email box or on GRAND. It is on October 5. Hope all is well. All is well here. Most warmly, Honey

Thank you so much for sharing this information. Getting bills you’re not prepared for after a stay in the hospital can be so scary. I want to be sure I have the best coverage. I am going to contact them.

If you join my private facebook group, GRANDwomenwithmoxie….where loneliness disappears you can join me for a free seminar with Chapter. Join the group. There will be a sign up sheet and possibly a sign up sheet on HoneyGood.com. I will be there, for sure because I feel as you do. And, it is free. Warmly, Honey