We decided to take Social Security at age 62. We know there are as many ways to consider this decision as there are days in a year. And many experts advise against taking social security “early” so that you get a bigger check at full retirement age. It is hard to argue against that.

We have always lived an unconventional lifestyle and the fact that so many experts agree on waiting for payment gives us pause for thought. Here is our logic.

First, the S&P 500 index has averaged over 8% per year, plus dividends, since we retired in 1991. If we take social security early and invest it, we won’t be losing the 8% per year the experts claim is the annual increase of waiting – although one is guaranteed and the other is not.

Maybe the markets will trend sideways or go down or even up, no one knows. For the last 27 years we have lived off of our investments through up and down markets, so investing the monthly check is definitely an option. More likely, we will just not spend our stash and look for opportunities in the markets as our cash positions grow. Plus we have control of the money at this point, adding to our net worth.

Next, let’s look at some numbers.

For easy math, say at 62 you are going to receive $1000.00 per month in benefits, but if you wait until you are 66, your payment will be $1360 ($1000 x 8% for the four years you have waited). Sounds great, right?

However, you would have missed receiving $48,000 dollars in payments from the previous 48 months. How long is it before you make that money back? Using this example it would take 133 months or a little over 11 years ($48,000 divided by $360) and that would put us at 77 years of age, just to break even. In that time frame, the Social Security we are receiving plus our investments should grow far outpacing the extra money received by waiting.

For some people, deferring until their full retirement age could make sense, especially if they do not have the assets to support themselves, are poor at handling money or if they are still working. However, this is not our situation and therefore we decided to take the money and run.

It’s really a question of who you think can handle your money better; You or Uncle Sam?

Update

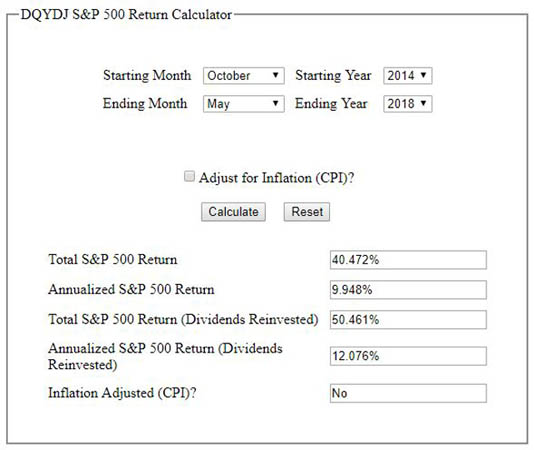

Below is the return of the S&P 500 Index since we took Social Security at 62.

About the Authors

Billy and Akaisha Kaderli are recognized retirement experts and internationally published authors on topics of finance, medical tourism, and world travel. With the wealth of information they share on their award-winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available on their website bookstore or on Amazon.com.

Another reason to take SS at 62 is that if you die, the government gets all your benefits unless you have a dependent or spouse that would be eligible. I have neither, so it seemed foolish to possibly leave that money on Uncle Sam’s table.

You make a very good point, Gwen. In our case, we preferred to invest our own money instead of having Uncle Sam keep it. This allowed us to gift to loved ones, invest, or to travel.

O M G This changes everything !!! I think I need to read your books. I am 58, so I have time to adjust and plan for retirement at 62 ??? Yes !!! Thank you for posting !!

You are welcome, Jo Ann. Feel free to write to us any time. We will answer your retirement questions!

What about health insurance when retiring at 62? Isn’t it extremely expensive for a 62-65 year old to purchase on the open market?

You make a very good point, Gwen. In our case we decided to manage our money ourselves, which allowed us to gift money to loved ones, invest, or to travel.

Jo Ann, feel free to write to us any time. We will answer your questions on retirement!

Karen, taking SS at age 62 is different than the health insurance conundrum. In our case, we travel the world and utilize Medical Tourism. Or you might be on your husband’s health insurance plan. Or having this extra money sooner could allow you to relocate to Mexico, Panama, or elsewhere, where insurance is cheaper.

Excellent way of showing the numbers in easy to understand and read format. thank you!

Thanks, LeAna, for taking the time to comment. Glad you enjoyed the article!